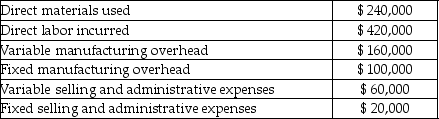

Pluto Incorporated provided the following information regarding its single product:  The regular selling price for the product is $80. The annual quantity of units produced and sold is 40,000 units (the costs above relate to the 40,000 units production level) . The company has excess capacity and regular sales will not be affected by this special order. There was no beginning inventory.

The regular selling price for the product is $80. The annual quantity of units produced and sold is 40,000 units (the costs above relate to the 40,000 units production level) . The company has excess capacity and regular sales will not be affected by this special order. There was no beginning inventory.

What would be the effect on operating income of accepting a special order for 1,500 units at a sale price of $50 per product assuming additional fixed manufacturing overhead costs of $10,000 are incurred?

Definitions:

Terrestrial Ecosystem

A community of living organisms and their physical environment, found on land areas rather than in aquatic settings.

Precipitation

Any form of water - liquid or solid - that falls from the atmosphere and reaches the ground, including rain, snow, sleet, and hail.

Transpiration

The method through which water is transported within plants from the roots to tiny openings under the leaves, transforming into vapor there and then being emitted into the air.

Evaporation

Evaporation is the process by which water is transformed from a liquid state into vapor, often driven by heat and leading to the cooling of surfaces.

Q28: Monroe Manufacturing produces and sells a product

Q40: Goal incongruence frequently exists in decentralized organizations.

Q59: Which of the following alternatives reflects the

Q80: The sales mix cannot significantly affect CVP

Q117: The operating budgets of retailers and manufacturers

Q150: Strategic planning involves setting long-term goals that

Q155: Fixed costs that are allocated among all

Q164: If the selling price per unit is

Q170: Which of the following is a potential

Q259: An R-square statistic of 0 indicates a