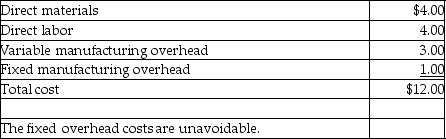

Cruise Company produces a part that is used in the manufacture of one of its products. The unit manufacturing costs of this part, assuming a production level of 6,000 units, are as follows:  Assume Cruise Company can purchase 6,000 units of the part from Suri Company for $14.00 each, and the facilities currently used to make the part could be used to manufacture 6,000 units of another product that would have an $8 per unit contribution margin. If no additional fixed costs would be incurred, what should Cruise Company do?

Assume Cruise Company can purchase 6,000 units of the part from Suri Company for $14.00 each, and the facilities currently used to make the part could be used to manufacture 6,000 units of another product that would have an $8 per unit contribution margin. If no additional fixed costs would be incurred, what should Cruise Company do?

Definitions:

Credit Score

A numerical expression based on a level analysis of a person's credit files, representing the creditworthiness of an individual.

Terms of Sale

The conditions under which a seller will sell and deliver goods to a buyer, detailing payment terms, delivery times, and other conditions of the sale.

Granting Credit

The process of providing a loan or other form of credit to a borrower or customer, often with specific terms and conditions.

Net Present Value

A calculation used to assess the profitability of an investment or project, considering the time value of money by discounting future cash flows to their present value.

Q8: Kent Coffee Haus sells Drip Coffee, Cappuccino,

Q14: The cash budget is prepared before the

Q47: Brigg's Breakfast Appliances manufactures two products: Waffle

Q71: Residual income is the difference between revenues

Q95: A product is sold at $6 per

Q96: Ideal standards allow for a normal amount

Q142: Pluto Incorporated provided the following information regarding

Q181: Goliath Company prepared the following purchases budget:

Q194: Part P40 is a part used in

Q223: A company's margin of safety can be