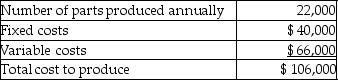

Part P40 is a part used in the production of air conditioners at Jackson Corporation. The following costs and data relate to the production of Part P40:  Jackson Corporation can purchase the part from an outside supplier for $4.25 per unit. If they purchase from the outside supplier, 50% of the fixed costs would be avoided. If Jackson Corporation buys the part, what is the most Jackson Corporation can spend per unit so that operating income is equal to $97,000?

Jackson Corporation can purchase the part from an outside supplier for $4.25 per unit. If they purchase from the outside supplier, 50% of the fixed costs would be avoided. If Jackson Corporation buys the part, what is the most Jackson Corporation can spend per unit so that operating income is equal to $97,000?

Definitions:

Net Purchases

The total amount of purchases made by a business minus returns, allowances, and discounts.

Intraperiod Tax Allocation

The process of apportioning income taxes within a single fiscal period among different sections of a financial statement.

Extraordinary Items

Events and transactions that are distinct from the ordinary activities of a company and have a significant impact on its financial position.

Discontinued Operations

Parts of a company's business that have been sold, disposed of, or otherwise terminated, which are reported separately from continuing operations in financial statements.

Q13: Sally's Gift Baskets sells gift baskets, on

Q14: Brittany Furniture manufactures two products: Couches and

Q26: A "relevant cost" is best described by

Q51: A direct materials flexible budget variance can

Q51: Most companies use _ when developing the

Q141: The _ technique asks what a result

Q159: Goliath Company prepared the following purchases budget:

Q168: Sound Design sells its computer speakers for

Q171: Tommy's Toys produces two types of toys:

Q207: The difference between actual results and budgeted