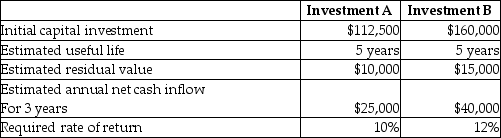

Pitt Company is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:  How long is the payback period for Investment B?

How long is the payback period for Investment B?

Definitions:

Mark-Up

The amount added to the cost price of goods to cover overhead and profit in setting the selling price.

Cost Method

An accounting approach where investments are recorded at their acquisition cost, without reflecting the investor's share of the investee's profits or losses until dividends are received.

Effective Tax Rate

reflects the percentage of income paid as tax, taking into consideration both federal and state taxes, and deductions.

Consolidated Retained Earnings

The accumulated net income of a company after dividends are paid, combined from all its divisions or subsidiaries.

Q9: Michael Corporation manufactures railroad cars, which is

Q44: Spinelli Company is deciding whether to automate

Q54: The "rate of return that makes the

Q67: The following information relates to Woolf Unlimited

Q78: Farrar Industries reported the following results from

Q83: Direct labor standards are becoming less relevant

Q112: (Present value tables are needed.)O'Mally Department Stores

Q113: Razzle Baking Company gathered the following actual

Q114: Dagny Enterprises has a target rate of

Q115: The formula to compute the debt ratio