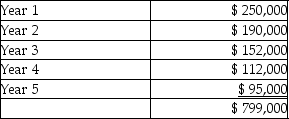

(Present value tables are needed.) Somerville Corporation is considering investing in specialized equipment costing $618,000. The equipment has a useful life of 5 years and a residual value of $55,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are:  Somerville Corporation's required rate of return is 14%.

Somerville Corporation's required rate of return is 14%.

The net present value of the investment is closest to

Definitions:

Account Payable

Money owed by a business to its suppliers or creditors for goods and services purchased on credit, considered a current liability.

Owner's Equity

The residual interest in the assets of the entity after deducting liabilities, representing the ownership interest of shareholders.

Cash Payment

A transaction that involves the immediate transfer of cash from the buyer to the seller for the purchase of goods or services.

Liabilities

Financial obligations or debts that a company owes to others, which must be paid back in the future.

Q37: One disadvantage of the payback method is

Q65: Litchfield Industries gathered the following information for

Q80: A company acquires its own stock to

Q82: When selecting a capital investment project from

Q87: Materials costs of product outputs category is

Q92: Which of the following organizations are continually

Q108: Ferrero Company reported the following information for

Q110: (Present value tables are needed.)Cleveland Cove Enterprises

Q128: A company uses the indirect method to

Q128: The Hummel Corporation reported the following income