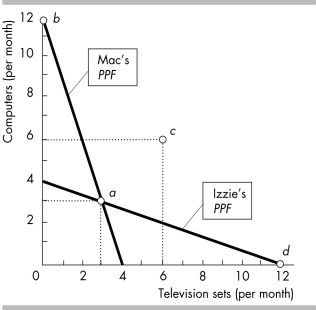

-In the figure above, if Mac and Izzie both completely specialized and traded with one another, their joint output would be

Definitions:

Interest Rate Swap

A financial derivative contract where two parties exchange interest rate payments, typically one with a fixed rate and the other with a floating rate.

Futures Put Option

A financial contract giving the buyer the right, but not the obligation, to sell a futures contract at a specified price within a specified time.

Sale Price

Sale price refers to the final price at which a product or service is sold after any discounts or promotions are applied.

Interest Rate Swaps

Financial derivatives in which two parties exchange interest rate obligations on debt, often switching between fixed and variable rates.

Q46: The opportunity cost of producing a unit

Q89: The above table shows production combinations on

Q110: Compare and contrast production efficiency and allocative

Q127: When economic growth occurs, the<br>A) economy moves

Q190: Suppose that the government is trying to

Q221: Any point on a production possibilities frontier

Q228: When supply decreases and demand does not

Q256: The above figures show the market for

Q480: The figure above shows the demand for

Q492: The quantity of CDs that firms plan