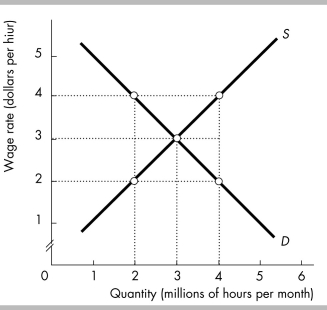

-In the figure above, if the minimum wage is $2 per hour, then

Definitions:

Federal Income Tax

The tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Withholdings

The portion of an employee's earnings that is deducted and sent directly to the government by the employer for tax purposes.

Salaries Expense

The total amount paid to employees in salary form over a specified accounting period, considered an operating expense.

Notes Payable

Short-term or long-term liabilities representing amounts owed for borrowed funds, documented by a promissory note.

Q44: Marginal utility theory assumes that when Sally

Q90: The above figure shows the market for

Q99: Imposing a minimum wage that is above

Q103: In the above figure, 300,000 purses per

Q144: A key difference between tariffs and quotas

Q150: Tariffs and import quotas differ in that<br>A)

Q171: The United States has a comparative advantage

Q224: To try to help farmers, governments I.

Q241: The amount of a tax paid by

Q371: The figure above shows the market for