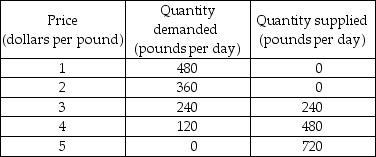

-The table above shows the demand and supply schedules for the market for coffee in Roastville. A tax on coffee of 75 cents per pound is proposed and the local government asks you to examine the effects of the tax.

a) Draw the demand and supply curves. If there is no tax on coffee, what is the price and how many pounds are sold?

b) With the tax, what is the price that consumers pay? What is the price that sellers receive? How many pounds of coffee are sold?

c) What is the government's total tax revenue? How much of the 75¢ per pound tax is paid by buyers? How much is paid by sellers?

d) If there are no external costs and benefits, what is the efficient level of coffee production?

e) If the tax is imposed, will the level of production be efficient? Why or why not?

Definitions:

Allowance for Doubtful Accounts

An accounting method used to estimate the portion of a firm's receivables that it expects will not be collected.

Net Credit Sales

The total revenue from sales made on credit after deducting any returns or allowances, representing the true credit sales figure.

Percentage-of-Sales Basis

A method used in budgeting and planning where certain costs or expenses are based on a fixed percentage of sales.

Accounts Receivable

Money owed to a business by its clients for goods or services that have been delivered but not yet paid for.

Q46: When the United States exports a good,

Q58: As Sally increases her consumption of a

Q117: Because a subsidy raises marginal benefit, it

Q122: In May 2008, Switzerland co-hosted the international

Q128: Suppose that you consume only pizza, which

Q156: Sue consumes only sub sandwiches and Mountain

Q276: With rent controls, which of the following

Q295: The above figure shows the market for

Q313: Danny has $12 to spend on two

Q349: The figure shows the market for books