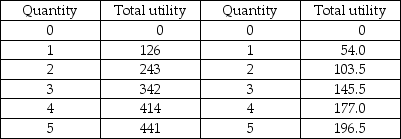

Eclairs Cream puffs

-The table gives the total utility Jamal derives from the consumption of eclairs and cream puffs. Jamal has $12 to spend on these two confectionery goods. The price of an eclair is $3 and the price of a cream puff is $1.50.

a) Jamal's budget is $12. In order for Jamal to maximize his utility, how many eclairs and cream puffs should he buy?

b) Suppose the price of an eclair increase to $6. Jamal's income does not change and neither does the price of a cream puff. What combination of eclairs and cream puffs will Jamal buy now?

c) Using your answers to parts (a) and (b), derive two points on Jamal's demand curve for eclairs.

Definitions:

Operations

The day-to-day activities necessary for a business to function, including production, sales, and administration.

PP&E

Property, Plant, and Equipment - tangible long-lived assets used in the normal course of business to produce goods and services.

Sale Of Land

This transaction involves the disposal of land owned by an entity, which can affect the financial statements through gains or losses.

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments not considered cash equivalents, as referred to in a company's cash flow statement.

Q47: The table above shows Tom's total utility

Q61: The table above gives Cathy's total utility

Q75: The above figure shows your budget line

Q152: The figure above shows Sam's budget line.

Q162: It is possible for the United States

Q165: The budget line can shift or rotate<br>A)

Q204: Which two goods will most likely have

Q252: Jane spends her monthly dining-out budget of

Q296: The price effect refers to how changes

Q365: As a consumer moves along an indifference