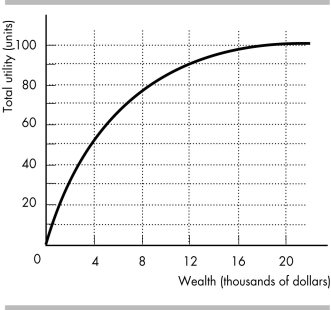

-Larry owns a car worth $20,000, and that is his only wealth. There is a 10 percent chance that Larry will have an accident within a year. If he does have an accident, his car is worthless. Larry's utility of wealth curve is shown in the figure above. An insurance company agrees to pay a car owner like Larry the full value of his car in case of an accident if the car owner buys the company's insurance policy. The company's operating expenses are $2,500 per policy.

a) What is Larry's expected wealth?

b) What is Larry's expected utility?

c) What is the maximum amount that Larry is willing to pay for car insurance?

d) What is the minimum premium that the insurance company is willing to accept?

e) Will Larry buy the insurance policy? Why or why not?

Definitions:

Q7: A company uses 4 pounds of

Q13: A financial planner wants to design a

Q14: A production optimization problem has 4

Q19: When might a network flow model for

Q21: Which of the following groups is the

Q27: Bill purchases property insurance for his office

Q38: Refer to Exhibit 3.3. Which cells should

Q111: Which of the following is TRUE regarding

Q208: Paying salespeople a fixed wage contract, one

Q253: By human capital, economists mean<br>A) machines that