Exhibit 3.4

The following questions are based on this problem and accompanying Excel windows.

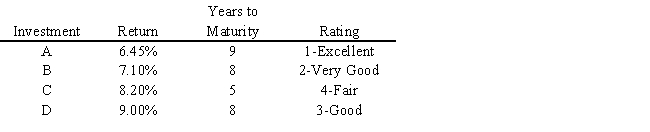

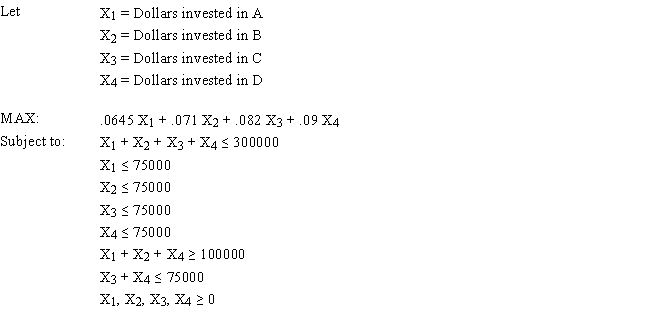

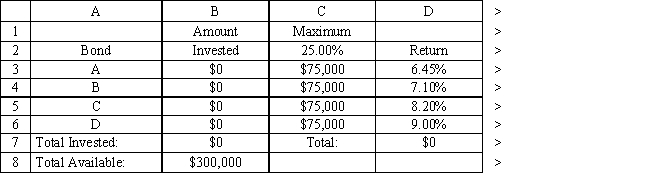

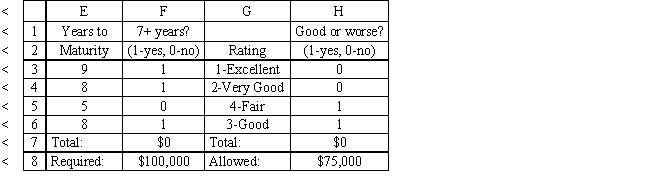

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

-Refer to Exhibit 3.4. What formula should be entered in cell B7 in the accompanying Excel spreadsheet to compute total dollars invested?

Definitions:

Consumption Demand

The desire and ability of consumers to purchase goods and services in an economy, determining the overall level of consumption.

Automatic Stabilizers

Programs and policies in economics formulated to counter changes in a nation's economic status, without the need for more intervention from governmental bodies or policymakers.

Business Cycle

A recurring sequence of economic expansion and contraction phases experienced by a country's economy.

Public Debt

The total amount of money owed by the government to creditors, which can include domestic or foreign individuals, corporations, or other governments.

Q2: Based on the following regression output, what

Q3: Refer to Exhibit 9.2. Interpret the meaning

Q9: <br>You have been hired by the city

Q14: Refer to Exhibit 6.2. What formula would

Q16: Bruce Copperwood's utility of wealth curve is

Q35: A hospital needs to determine how many

Q42: Variables, which are not required to assume

Q45: Which balance of flow rule should

Q50: Clifton Distributing has three plants and four

Q142: Adriana wants to try working as an