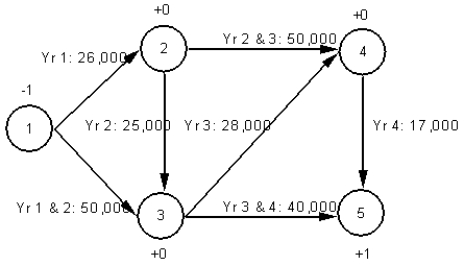

A company wants to determine the optimal replacement policy for its photocopier. The company does not keep photocopiers longer than 4 years. The company has estimated the annual costs for photocopiers during each of the 4 years and developed the following network representation of the problem.

Write out the LP formulation for this problem.

Definitions:

Adjusted Gross Income

An individual's total gross income minus specific deductions, used to determine taxable income and eligibility for certain tax benefits.

At-Risk Amount

The maximum amount of money an investor stands to lose in an investment, which limits loss deduction claims for tax purposes.

Passive Loss Rules

are tax rules that limit the ability to deduct losses from passive activities unless the taxpayer materially participates in the activity.

Passive Activity

Economic activities in which the investor does not materially participate, often related to rental property or businesses in which the person does not actively manage.

Q2: Refer to Exhibit 7.4. The spreadsheet model

Q5: Which point or points are local optima

Q5: Dave Cummins runs a local bowling

Q29: A company needs to hire workers to

Q41: A company wants to build a new

Q43: A research director must pick a subset

Q44: Refer to Exhibit 11.1. What is the

Q45: Identifying the real problems faced by the

Q75: The International Maritime Bureau said the waters

Q81: Refer to Exhibit 3.3. Which cells should