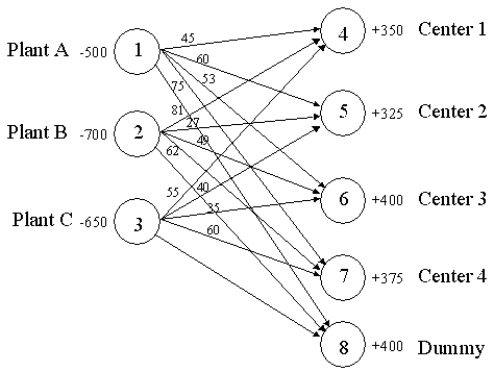

The following network depicts a balanced transportation/distribution problem for Clifton Distributing. Formulate the LP for Clifton assuming they wish to minimize the total product-miles incurred.

Definitions:

Personal Income Tax

A tax levied on individuals or households based on the level of their income.

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government, after deductions and exemptions.

Marginal Tax Rate

It is the rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your income for each tax bracket in which you qualify.

Taxable Income

The amount of income subject to taxes, after all deductions and exemptions are taken into account.

Q9: Refer to Exhibit 10.2. What is the

Q19: <br>Recent growth in the college's enrollment

Q22: Refer to Exhibit 11.8. What formula should

Q24: The reason an analyst creates a regression

Q27: The branch-and-bound algorithm starts by<br>A)relaxing all the

Q30: Refer to Exhibit 10.6. Compute the discriminant

Q40: A company wants to locate a new

Q58: Using the information in Exhibit 12.2, what

Q63: Ashton has the utility of wealth curve

Q77: Refer to Exhibit 11.2. What is the