The following questions pertain to the problem, formulation, and spreadsheet implementation below.

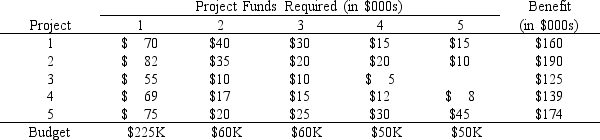

A research director must pick a subset of research projects to fund over the next five years. He has five candidate projects, not all of which cover the entire five-year period. Although the director has limited funds in each of the next five years, he can carry over unspent research funds into the next year. Additionally, up to $30K can be carried out of the five-year planning period. The following table summarizes the projects and budget available to the research director.

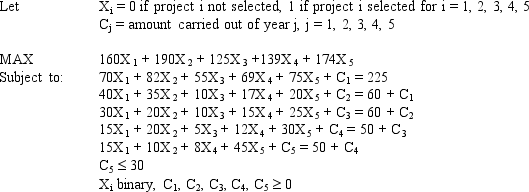

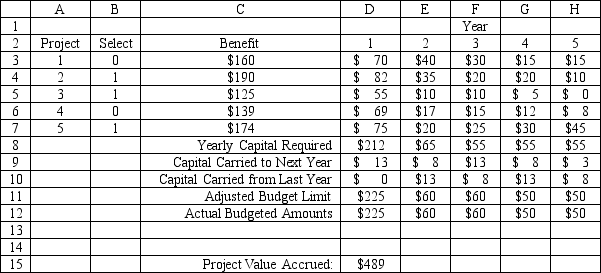

The following is the ILP formulation and a spreadsheet model for the problem.

The following is the ILP formulation and a spreadsheet model for the problem.

-Refer to Exhibit 6.1. What values would you enter in the Risk Solver Platform (RSP) task pane for the above Excel spreadsheet?

Objective Cell:

Variables Cells:

Constraints Cells:

Definitions:

Bond Matures

The point in time when a bond's principal amount is payable to the bondholder, and the obligation of the issuing party ends.

Current Market Value

The present financial value of an asset or company based on its trading price in the market, subject to fluctuations.

Effective Yield

This is the total yield on an investment expressed on an annual basis, taking into account the compounding of interest.

Interest Rate

The annual rate at which interest is charged to the borrower, represented as a percentage of the still unresolved loan amount.

Q3: Refer to Exhibit 8.2. What values would

Q5: Refer to Exhibit 10.6. Compute the discriminant

Q28: A dietician wants to formulate a low

Q39: Mortgage insurance protects lenders when a borrower

Q44: An investor is developing a portfolio of

Q53: Refer to Exhibit 11.7. What formula should

Q58: Which of the following special conditions in

Q69: How many local minimum solutions are there

Q71: If the allowable increase for a constraint

Q72: The absolute value of the shadow price