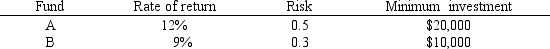

An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment. The investor can invest to maximize the expected rate of return or minimize risk. Any money beyond the minimum investment requirements can be invested in either fund.Formulate the MOLP for this investor.

Note that a low Risk rating means a less risky investment. The investor can invest to maximize the expected rate of return or minimize risk. Any money beyond the minimum investment requirements can be invested in either fund.Formulate the MOLP for this investor.

Definitions:

Investing Activities

Financial transactions involving the purchase and sale of long-term assets and other investments not included in cash equivalents.

Cash Flow Statement

A financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources, as well as all cash outflows that pay for business activities and investments during a given period.

Statement of Cash Flows

This document details the combined amount of cash a business gains from its day-to-day operations and outside investments, and the cash it expends on operating and investing activities over a particular period.

Indirect Method

A method of calculating cash flows from operating activities in the cash flow statement by adjusting net income for changes in non-cash accounts.

Q2: Refer to Exhibit 7.4. The spreadsheet model

Q5: What is the probability that it

Q20: Which Risk Solver Platform (RSP) function will

Q23: Why does the GRG algorithm not provide

Q25: The standard error measures the<br>A)variability in the

Q33: A sub-problem in a B & B

Q34: If we do not identify the correct

Q39: The "Analyze Without Solving" tool in Risk

Q50: Refer to Exhibit 9.5. Based on the

Q58: A company wants to build a new