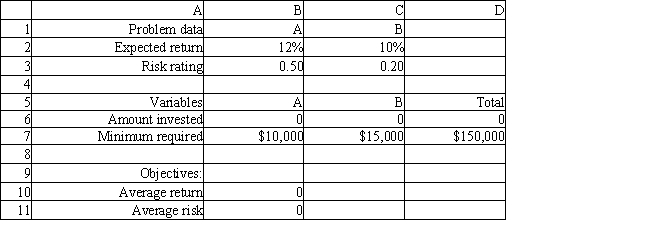

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. Which cell(s) is(are) the target cells in this model?

Definitions:

Neurons

Specialized cells in the nervous system that transmit information through electrical and chemical signals.

Myelin Sheath

A fatty covering that surrounds axons of some nerve cells, facilitating faster transmission of electrical impulses.

Myelin

A fatty substance that surrounds neurons' axons, helping to speed up the transmission of electrical signals in the nervous system.

Neurons

Electrically excitable cells in the nervous system that process and transmit information through electrical and chemical signals.

Q13: Refer to Exhibit 10.3. What formulas should

Q17: The goal of the modeling approach to

Q20: In a transshipment problem, which of

Q26: A small town wants to build some

Q29: An office supply company is attempting to

Q40: <br>Handel Manufacturing produces test stands for

Q49: In which of the following categories of

Q50: What gallery distribution should be used for

Q64: A barber shop has one barber, a

Q79: A time series which has a significant