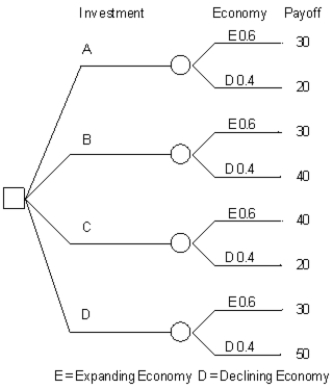

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

-A square node in a decision tree is called a(n) ____ node.

Definitions:

Sixth Circuit

A federal judicial circuit in the United States that encompasses parts of the Midwest, including Kentucky, Michigan, Ohio, and Tennessee.

Eighth Circuit

Refers to the United States Court of Appeals for the Eighth Circuit, a federal court with appellate jurisdiction over the district courts in certain Midwestern and Southern states.

Case on All Fours

Describes a case with factual and legal circumstances so similar to a case at hand that its precedent is considered highly persuasive.

Plaintiff

The party who initiates a lawsuit by filing a complaint against the defendant alleging wrongdoing.

Q4: Refer to Exhibit 10.1. What is the

Q11: An investor is developing a portfolio of

Q13: Refer to Exhibit 11.2. What formula should

Q13: Refer to Exhibit 10.3. What formulas should

Q27: Refer to Exhibit 14.9. Assume the formula

Q41: If using the regression tool for two-group

Q49: Which of the following goodness-of-fit measures is

Q51: A company wants to locate a new

Q53: Ferris owns an interest in,but does not

Q116: A C corporation has a fiscal year-end