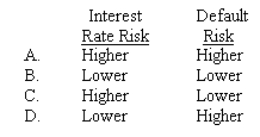

Which of the following descriptions most accurately reflects the risk position of an ARM lender in comparison to that of a FRM lender?

Definitions:

Retained Earnings

The portion of net income not distributed to shareholders but reinvested in the business or kept as reserve.

Operational Funds

Money that is available for daily business activities, including salaries and maintenance, ensuring smooth operations.

Full Capacity Sales

Full capacity sales refer to the maximum sales level that a company can attain with its current production capacity and resources, without additional investment.

Net Income

A company's revenue minus all its expenses and taxes equals its total income.

Q3: The floor of an ARM is the

Q5: The expected cost of borrowing does not

Q17: A property that produces a level of

Q18: Prices of mortgage pass-through securities are:<br>A) unaffected

Q20: Besides an estimate of costs,a construction loan

Q21: Which of the following statements is true

Q23: Non-recourse debt,such as a mortgage on a

Q25: Points are also known as:<br>A) Third party

Q25: A small office building is purchased of

Q48: The associational unionism model is based on