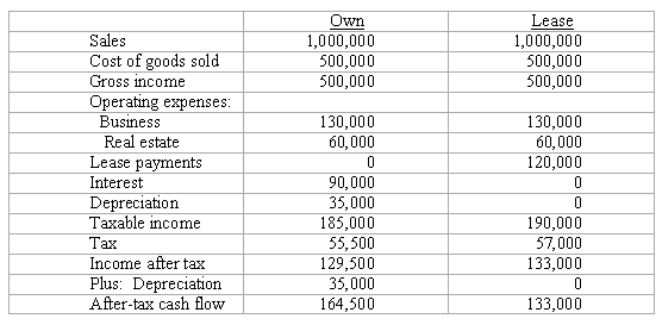

A company is planning to move to a larger office and is trying to decide if the new office should be owned or leased.Cash flows for owning versus leasing are estimated as follows.Assume that the cash flows from operations will remain level over a 10 year holding period.If purchased,the company will invest $385,000 in equity and finance the remainder with an interest-only loan that has a balloon payment due in year 10.The after-tax cash flow from sale of the property at the end of year 10 is expected to be $750,000.What is the incremental rate of return on equity to the company,if the property is owned instead of leased?

Definitions:

Financial Statement Presentation

The structured representation of the financial information, typically including the balance sheet, income statement, and cash flow statement, of an entity.

Return on Assets

This measures how efficiently a company's management is using its total assets to generate profits.

Asset Turnover

A financial ratio that measures the efficiency of a company's use of its assets to generate sales or revenue.

Average Total Assets

This metric calculates the average value of all assets owned by a company over a specific period, usually used in financial analysis to gauge productivity.

Q4: A futures instrument,such as a T-bill,can be

Q5: In Mexico,collective bargaining agreements are sometimes said

Q10: In comparison to the first month's payment

Q17: REITs are required to pay out 95

Q18: When the value of public goods exceeds

Q22: One proposed reform to the NLRA would

Q23: Negative amortization reduces the principal balance of

Q28: A fee simple estates is a type

Q56: Setting an object's Enabled property to False

Q139: Government-controlled unions in Mexico are referred to