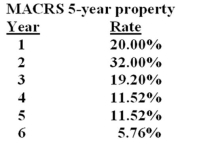

Winslow,Inc. is considering the purchase of a $225,000 piece of equipment. The equipment is classified as 5-year MACRS property. The company expects to sell the equipment after four years at a price of $50,000. What is the after-tax cash flow from this sale if the tax rate is 35%?

Definitions:

Financial Disclosure

The process of releasing all relevant financial information about a company to the public, ensuring transparency and aiding in informed decision making.

Internal Controls

Processes designed to ensure the reliability of financial reporting, effective and efficient operations, and compliance with laws and regulations.

Savings and Loan Associations

Financial institutions specializing in accepting savings deposits and making mortgage and other loans.

Governments

Institutions that exercise authority and perform the functions of governing a political state, region, or community through the exercise of legislative, executive, and judicial powers.

Q5: Which one of the following is most

Q27: The diversification effect of a portfolio of

Q29: The "EST SPREAD" shown in The Wall

Q41: If there is a conflict between mutually

Q56: The rate at which a stock's price

Q59: Which of the following amounts is closest

Q62: Explain why some bond investors are subject

Q71: Your mother helped you start saving $25

Q80: Jamie's Motor Home Sales currently sells 1,000

Q121: What is the future value of the