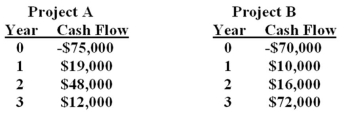

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based upon the internal rate of return (IRR) and the information provided in the problem,you should:

Definitions:

Predatory Pricing

A pricing strategy where a business sets very low prices with the intent to drive competitors out of the market or to prevent new entrants from gaining a foothold.

Retail Value

The total price at which a product or service is sold to consumers in the retail market, typically including the costs of production, distribution, and a markup for profit.

Verified

Confirmed as true, accurate, or to meet a particular standard.

Q8: Executive compensation is an important element of

Q19: Margarite's Enterprises is considering a new project.

Q21: An investment has the following cash flows.

Q28: An investment with an initial cost of

Q45: Emmett Corporation has issued a $1,000 face

Q46: The only difference between Joe's and Moe's

Q50: _ is the process of the board

Q77: The Can-Do Co. is analyzing a proposed

Q88: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2359/.jpg" alt=" What is the

Q104: Which is a more meaningful measure of