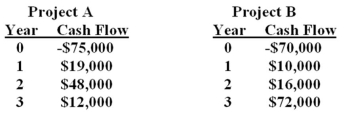

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Required rate of return 10% 13%

Required rate of return 10% 13%

Required payback period 2.0 years 2.0 years

Based upon the payback period and the information provided in the problem,you should:

Definitions:

Opportunity Costs

The benefit that is missed or foregone when choosing one alternative over another.

Trading Costs

Expenses associated with buying and selling securities, including broker commissions and spreads.

Speculative Motive

This motive describes the intention to hold cash for the purpose of taking advantage of opportunities that may arise, such as purchasing assets expected to increase in value.

Lockboxes

A service provided by banks to process payments quickly by having those payments directed to a special post office box rather than to the company.

Q5: What best describes transferability of investor interests?<br>A)

Q6: The stated interest payment,in dollars,made on a

Q33: All else constant,a coupon bond that is

Q36: The Walker Landscaping Company can purchase a

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2359/.jpg" alt=" What is the

Q41: Discuss the difference between book values and

Q50: A situation in which accepting one investment

Q66: The present value of future cash flows

Q96: Corporate citizenship refers to _ responsibility.<br>A) Economic<br>B)

Q126: You hope to buy your dream house