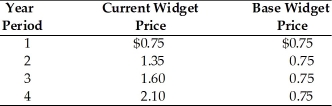

-According to the above table, in the base period (Year 1) , the price index is

Definitions:

Premium Bonds

Bonds sold for more than their face value due to offering interest rates higher than the current market average.

Discount Bonds

Bonds that are sold for less than their face value, typically reflecting that the market interest rates are higher than the bond's coupon rate.

Bond Price

The amount of money for which a bond is bought or sold in the market, influenced by interest rates, credit quality, and maturity period.

YTM

Yield to Maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturity date, accounting for its current market price, interest payments, and time value.

Q20: A valid rationale for the decision NOT

Q33: Sales taxes are routinely collected by<br>A) the

Q95: Social Security contributions are<br>A) a voluntary dollar

Q96: If Jack refinished his basement himself, the

Q109: The economic problem with Medicare financing is

Q125: Suppose that for the economy of Springfield,

Q181: Frictional unemployment would increase when<br>A) migrant workers

Q185: According to the above table, national income

Q305: Excluding indirect business taxes and depreciation, Gross

Q364: The difference between Gross Domestic Income (GDI)