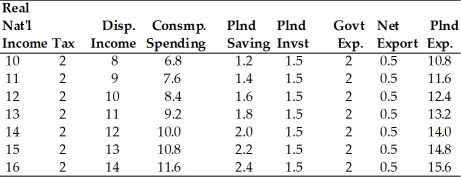

-Refer to the above table. When real GDP equals $10 trillion,

Definitions:

Personal Income Taxes

Taxes levied on the income of individuals, typically graduated so that higher income levels are taxed at higher rates.

Progressive

Describes a tax system where the tax rate increases as the taxable base amount increases, typically aimed at reducing income inequality.

Proportional

Having a constant relation in degree or number between two or more variables.

Regressive

Describing taxes or policies that take a larger percentage from low-income earners than from high-income earners.

Q31: Which of the following actions could be

Q40: Which formula is correct?<br>A) S = <img

Q114: Which of the following is a stock

Q159: Consumption expenditures include all of the following

Q164: If we observe that interest rates rise

Q229: Refer to the above table. Which variables

Q250: An advantage of automatic stabilizers over discretionary

Q313: In the consumption function model, the 45-degree

Q324: According to the above figure, the average

Q436: The multiplier effect applies to any<br>A) change