A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be $15,000 for A,$30,000 for B,$45,000 for C,and $60,000 for D if state of nature 1 occurs; and $60,000 for A,$80,000 for B,$90,000 for C,and $35,000 for D if state of nature 2 occurs.

(i)If P(State of Nature 1)is .40,what alternative has the highest expected monetary value?

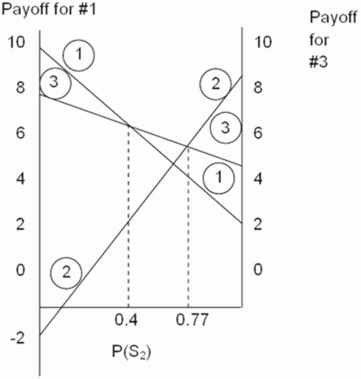

(ii)Determine the range of P(S2)for which each alternative would be optimal.

Definitions:

Cognitive Dissonance

The mental discomfort experienced by an individual who holds two or more contradictory beliefs, ideas, or values at the same time, leading to a motivation for change.

IQ Scores

Numerical measurements that represent an individual's level of intelligence as compared with the statistical norm.

Integrated Regulation

A concept in self-determination theory where behavior is motivated by internal rewards and the process of assimilating regulations to oneself.

Internal Information

Data, insights, or knowledge that originates within an organization, system, or individual's own thoughts and experiences.

Q2: Production process design involves translating the "voice

Q22: What is the linear regression trend line

Q29: Heuristic approaches to line balancing guarantee an

Q31: A firm is considering three capacity alternatives:<br>

Q72: The linear optimization technique for allocating constrained

Q82: The standard time for a job is

Q86: A manager uses this equation to predict

Q123: Demand for the last four months was:<br>

Q143: The advantages of automation include:<br>I.Reduced output variability<br>II.Reduced

Q155: Centred moving averages (CMA)is a better way