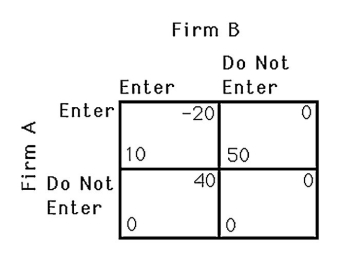

-The above figure shows the payoffs to two airlines,A and B,of serving a particular route.Is there a Nash equilibrium? What is it? Explain.

Definitions:

Basis Risk

Risk attributable to uncertain movements in the spread between a futures price and a spot price.

Short Hedger

An investor who enters into futures contracts to protect against potential price declines in an asset they hold.

Futures Price

The agreed-upon price for the sale/purchase of an asset at a future date, as determined in a futures contract.

Metals

Elements that are typically hard, shiny, malleable, fusible, and ductile, with good electrical and thermal conductivity, used in a wide range of industrial and decorative applications.

Q12: Politicians often highlight the plight of a

Q16: For a given expected value,the smaller the

Q29: Suppose two duopolists operate at zero marginal

Q56: A single-period duopoly firm can choose output

Q57: Explain the externality generated when a shepherd

Q64: The above figure shows the payoffs to

Q75: What is the primary difference between bundling

Q83: Catherine is risk-averse.When faced with a choice

Q85: The above figure shows the payoff matrix

Q106: Why don't we see firms tie-in the