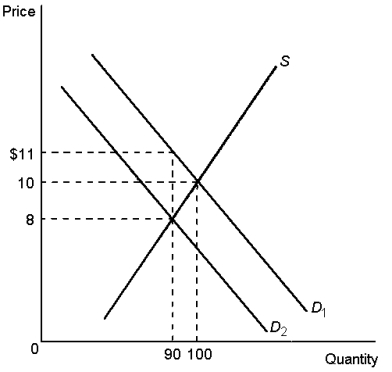

Graph 6-11

-Using Graph 6-11, answer the following questions.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

f. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Direct Materials Purchases Variance

This term refers to the difference between the actual cost of materials purchased and the expected (standard) cost of materials needed to manufacture the products during a specific period.

Materials Price Variance

The difference between the actual cost of materials and the expected (standard) cost.

Raw Material

The basic material from which a product is made, used in the initial stages of production.

Materials Price Variance

The difference between the actual cost of materials and the standard cost multiplied by the quantities purchased.

Q35: 'Tariffs are needed to reduce imports during

Q46: Many economists oppose the infant industry argument

Q59: Because taxes distort incentives, they cause markets

Q85: Assume that the demand for salt is

Q88: Get Smart University (GSU) is contemplating increasing

Q96: What will happen to supply or quantity

Q109: What is the relationship between the demand

Q130: A reduction in an input price will

Q140: In Graph 9-9, the free-trade price and

Q151: If you pay a price exactly equal