Graph 6-7

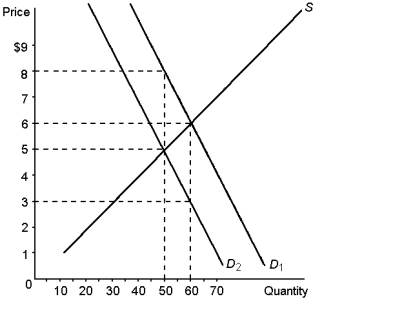

-According to Graph 6-7, the amount of the tax that buyers would pay would be:

Definitions:

Pay Period

Pay period refers to the recurring length of time over which employee wages are calculated and distributed, such as weekly, bi-weekly, or monthly.

FICA Taxes

Taxes imposed by the Federal Insurance Contributions Act, which fund Social Security and Medicare, required to be withheld from employees' paychecks and matched by employers.

OASDI

Stands for Old-Age, Survivors, and Disability Insurance, a program that provides monthly benefits to retired individuals, survivors of deceased workers, and disabled workers funded through payroll taxes.

Q8: When an increase in the price of

Q18: Laissez-faire is a French expression that literally

Q62: How does producer surplus differ from the

Q64: In Graph 9-3, the free-trade price and

Q79: Suppose a tax is imposed on a

Q87: A multilateral approach to free trade can

Q101: At the equilibrium of supply and demand

Q118: Free markets allocate (1) the supply of

Q130: According to Graph 7-3, at the price

Q138: Price elasticity over any range of a