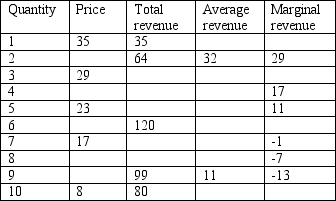

Table 15-1

-Refer to Table 15-1. If the monopolist wants to maximise its revenue, how many units of its product should it sell?

Definitions:

Tax Collections

The process of gathering taxes by government authorities from individuals and businesses.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxation by governmental authorities.

Tax-Exempt

Not subject to tax by federal or local governments, often applied to charitable organizations or certain financial earnings.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of additional income that is paid in taxes.

Q14: Because monopoly firms do not have to

Q38: In New Zealand, the telephone lines (and

Q49: An important implicit cost of almost every

Q71: If regulators impose marginal-cost pricing on a

Q82: When a profit-maximising firm in a monopolistically

Q97: The profit-maximising rule for a firm in

Q102: Two suspected drug dealers are stopped by

Q134: Refer to Table 13-3. One month the

Q155: Refer to Graph 14-2. When price falls

Q160: A profit-maximising monopolist chooses the output level