Your corporation has the following cash flows:

Operating income:$250,000

Interest received:10,000

Interest paid:45,000

Dividends received:20,000

Dividends paid:50,000

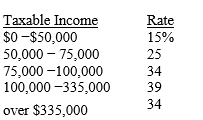

If 70 percent of dividends received are excludable,and if the applicable tax table is as follows, What is the corporation's tax liability?

What is the corporation's tax liability?

Definitions:

Immediate Reward

An immediate reward refers to a benefit or gratification received right after completing an action or behavior, emphasizing the lack of delay in receiving the outcome.

Good Grade

A high score or mark that reflects successful performance or understanding in an academic assessment or course.

Text Material

Refers to written or printed matter used for reading or study.

Anticipate

To expect or predict something to happen in the future, often taking steps in preparation for it.

Q6: A share of stock has a dividend

Q13: In general,when a firm decides to raise

Q24: Other things held constant,a high degree of

Q56: A _ exists when private enterprise reserves

Q58: You are considering an investment in a

Q73: Pepsi Corporation's current ratio is 0.5,while Coke

Q101: The current ratio and inventory turnover ratio

Q105: A firm has total interest charges of

Q117: You are given the following information about

Q120: If you buy a factory for $250,000