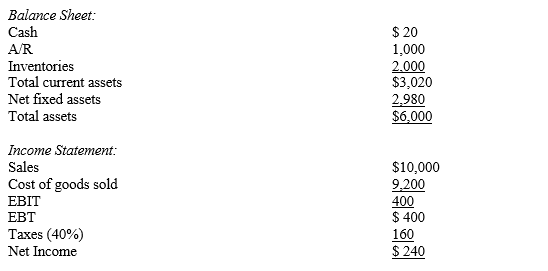

Collins Company had the following partial balance sheet and complete income statement information for 2010:  The industry average DSO is 30 (360-day basis) .Collins plans to change its credit policy so as to cause its DSO to equal the industry average,and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate) ,what will Collins' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the balance sheet?

The industry average DSO is 30 (360-day basis) .Collins plans to change its credit policy so as to cause its DSO to equal the industry average,and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate) ,what will Collins' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the balance sheet?

Definitions:

Nominal Interest Rate

The interest rate before adjustments for inflation, representing the raw interest percentage that lenders charge borrowers for the use of money.

Inflation Rate

The speed at which the aggregate price level for goods and services goes up, undermining the power of purchasing.

Nominal Interest Rate

The rate of interest before adjustments for inflation; the stated rate on a loan or investment.

Real Interest Rate

The Real Interest Rate is the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing or the true return on savings.

Q11: Assume the securities are all issued by

Q20: You intend to purchase a 10-year,$1,000 face

Q29: Which of the following statements is most

Q40: Default risk premiums<br>A) are unrelated to the

Q43: A(n)_ is generally obtained from a bank

Q58: If EBIT doubles when sales doubles,then the

Q66: An increase in the firm's inventory balance

Q86: A mutual fund that invests primarily in

Q92: A corporation with a marginal tax rate

Q93: Fractional reserves mean that banks maintain less