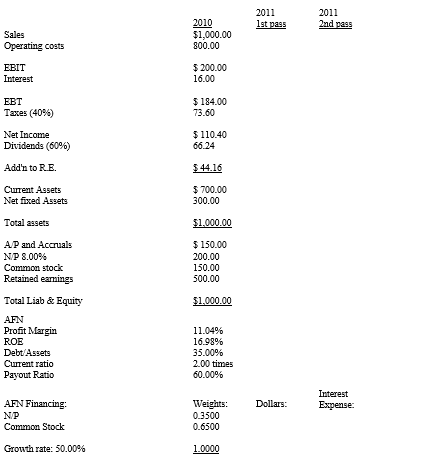

You have been given the information below on the Crum Company.Crum expects sales to grow by 50% in 2011,and operating costs should increase at the same rate.Fixed assets were being operated at 40% of capacity in 2010,but all other assets were used to full capacity.Underutilized fixed assets cannot be sold.Current assets and spontaneous liabilities should increase at the same rate as sales during 2011.The company plans to finance any external funds needed as 35% notes payable and 65% common stock.After taking financing feedbacks into account,and after the second pass,what is Crum's projected ROE using the projected balance sheet method?

Information on the Crum Company:

Definitions:

Net Operating Income

This refers to a company's income after operating expenses are deducted, but before interest and taxes are subtracted.

Grinding Minutes

The amount of time spent on grinding operations in the manufacturing process, often used as a measure of labor or machine use.

Variable Manufacturing Overhead

Costs in manufacturing that vary with operational output, such as indirect materials, utilities, and other expenses that increase with production volume.

Fixed Manufacturing Overhead

Regular, consistent costs associated with operating a manufacturing facility that do not vary with the level of production, such as salaries and rent.

Q5: What is the maximum change in total

Q10: The OTC market is a physical exchange,much

Q20: You intend to purchase a 10-year,$1,000 face

Q24: The liabilities of financial institutions primarily consist

Q42: The biggest reduction in risk would be

Q50: Long-term interest rates reflect expectations about future

Q76: The Federal Open Market Committee basically establishes

Q100: Silver King Inc.is currently running at 60

Q118: Other things held constant,which of the following

Q119: Which of the following statements is correct?<br>A)