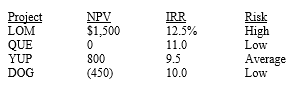

A college intern working at Anderson Paints evaluated potential investments⎯that is,capital budgeting projects⎯using the firm's average required rate of return (WACC) ,and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

Definitions:

White High School Graduates

Refers to individuals who have completed their high school education and identify as White in terms of racial classification.

Academic Achievement

The extent to which a student, teacher, or institution has achieved their short or long-term educational goals.

Math And Science

Math and science are academic disciplines focused on the study of numbers, quantities, and the natural world respectively, forming the foundation for numerous fields of research and technology.

Sense Of Independence

The feeling or state of being able to perform tasks, make decisions, and live one's life without excessive reliance on others.

Q12: Virus Stopper Inc. ,a supplier of computer

Q27: The text makes the point that due

Q31: Manufacturer's Inc.estimates that its interest charges for

Q39: When comparing two different stocks with the

Q51: The cost of capital should reflect the

Q69: DAA's stock is selling for $15 per

Q84: Elephant Books sells paperback books for $7

Q94: In a limited liability partnership only the

Q95: Tapley Inc.'s current (target)capital structure has a

Q111: Refer to Rollins Corporation.What is Rollins' cost