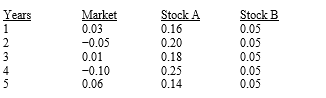

You have developed data which give (1) the average annual returns on the market for the past five years,and (2) similar information on Stocks A and B.If these data are as follows,which of the possible answers best describes the historical betas for A and B?

Definitions:

Down Payment

An initial upfront portion of the total amount due, typically associated with the purchase of expensive items like cars or real estate, to secure the deal.

Ordinary Annuity

A financial product involving regular payments received or paid over a designated period of time at equal intervals.

Financial Calculator

A specialized calculator designed to perform financial functions, including interest rate calculations, investment appraisal, amortization schedules, and more.

Compounded Semi-annually

Interest calculated twice a year on both the initial principal and the accumulated interest from previous periods.

Q2: Given the following information,calculate the market price

Q26: Hogan Inc.generated EBIT of $240,000 this past

Q31: A bank pays a quoted annual (simple)interest

Q44: Retained earnings is the cash that has

Q53: Your client just turned 75 years old

Q91: If investors become more averse to risk,the

Q100: Which of the following statements is correct?<br>A)

Q101: Company X has beta = 1.6,while Company

Q109: Repatriation of funds is not relevant in

Q118: One of the potential benefits of investing