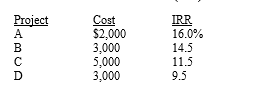

Anderson Company has four investment opportunities with the following costs (all costs are paid at t = 0) and estimated internal rates of return (IRR) :  The company has a target capital structure that consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share (i.e. ,

The company has a target capital structure that consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share (i.e. ,  = $3.00) .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

= $3.00) .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

Definitions:

Marketing Plan

A comprehensive document outlining the marketing strategies, tactics, and actions aimed at achieving the marketing objectives of a business.

Direct Suggestion

An approach that suggests prospects buy rather than telling them to buy.

Retirement Years

The period in a person's life after they have permanently left the workforce, typically involving receipt of retirement benefits.

Marketing Plan

A comprehensive document or blueprint that outlines a company's advertising and marketing efforts for a specific period.

Q26: You just graduated,and you plan to work

Q30: Which of the following statements is correct?<br>A)

Q83: A firm has the following balance sheet:<br>Cash:$

Q83: Conflicts between two mutually exclusive projects,where the

Q95: Dixie Tours Inc.buys on terms of 2/15,net

Q101: _ projects are a set of projects

Q116: Determination of a firm's investment in current

Q123: Refer to Real Time Inc.What is the

Q130: _ projects are projects whose cash flows

Q174: Normal Projects Q and R have the