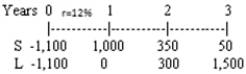

A company is analyzing two mutually exclusive projects,S and L,whose cash flows are shown below:  The company's required rate of return is 12 percent,and it can get an unlimited amount of funds at that rate.What is the IRR of the better project,i.e. ,the project which the company should choose if it wants to maximize the price of its stock?

The company's required rate of return is 12 percent,and it can get an unlimited amount of funds at that rate.What is the IRR of the better project,i.e. ,the project which the company should choose if it wants to maximize the price of its stock?

Definitions:

Preparation Stage

A phase in behavior change models where individuals get ready to change their habits or behaviors within the near future.

Maintenance Stage

A phase in the transtheoretical model where individuals sustain their behavior change over time and work to prevent relapse.

Transtheoretical Model

A theory of behavioral change that assesses an individual's readiness to act on a new healthier behavior, and provides strategies, or processes of change to guide the individual through the stages of change to Action and Maintenance.

Enabling Factors

Conditions or elements that facilitate the accomplishment of an action or the attainment of a goal, making processes easier or possible.

Q12: An increase in the discount rate used

Q71: Suppose a stock is not currently paying

Q82: Which of the following is not a

Q87: Lloyd Enterprises has a project which has

Q88: One implication of information asymmetry between investors

Q91: Your company's stock sells for $50 per

Q100: Which of the following statements concerning the

Q101: The holding period return associated with an

Q107: If the unit sales of a firm

Q157: Which of the following statements is correct?<br>A)