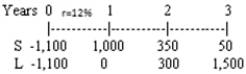

A company is analyzing two mutually exclusive projects,S and L,whose cash flows are shown below:  The company's required rate of return is 12 percent,and it can get an unlimited amount of funds at that rate.What is the IRR of the better project,i.e. ,the project which the company should choose if it wants to maximize the price of its stock?

The company's required rate of return is 12 percent,and it can get an unlimited amount of funds at that rate.What is the IRR of the better project,i.e. ,the project which the company should choose if it wants to maximize the price of its stock?

Definitions:

Inner Ear

The core section of the ear, which includes the cochlea, vestibule, and semicircular canals, plays a crucial role in both hearing and maintaining balance.

Stapedectomy

A surgical procedure to remove part or all of the stapes bone in the middle ear, usually to treat hearing loss caused by otosclerosis.

Stapes

The smallest bone in the human body, located in the middle ear, playing a key role in the transmission of sound vibrations.

Prosthesis

An artificial device used to replace a missing body part, such as a limb, tooth, eye, or heart valve.

Q16: The cost of capital used to evaluate

Q37: If the required rate of return on

Q53: An individual's risk tolerance level depends on

Q65: Which of the following statements is correct?<br>A)

Q101: Company X has beta = 1.6,while Company

Q104: A $1,000 par value bond sells for

Q129: Although the payback method ignores the time

Q141: Regarding the net present value of a

Q178: Which of the following capital budgeting techniques

Q186: Tapley Acquisition Inc.is considering the purchase of