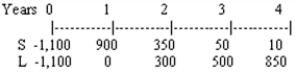

A company is analyzing two mutually exclusive projects,S and L,whose cash flows are shown below:  The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR. )

The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR. )

Definitions:

Q2: Assume that you plan to buy a

Q10: Regardless of what interest rates do in

Q24: Union Atlantic Corporation,which has a required rate

Q27: Which of the following statements is most

Q40: The firm's target capital structure is consistent

Q43: Do not use the APR formula for

Q43: Because the simple arithmetic return does not

Q63: A just-in-time system of inventory control requires

Q85: You have just purchased a life insurance

Q90: The two cardinal rules which financial analysts