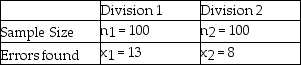

An accounting firm has been hired by a large computer company to determine whether the proportion of accounts receivables with errors in one division (Division 1)exceeds that of the second division (Division 2).The managers believe that such a difference may exist because of the lax standards employed by the first division.To conduct the test,the accounting firm has selected random samples of accounts from each division with the following results.

Based on this information,and using a significance level equal to 0.05,the pooled estimator for the overall proportion is

Based on this information,and using a significance level equal to 0.05,the pooled estimator for the overall proportion is  = .1050.

= .1050.

Definitions:

Financial Risk

The chance of incurring financial losses from an investment or business activity.

Operating Leverage

A measure that shows how revenue growth translates into growth in operating income, highlighting the impact of fixed costs.

Financial Performance

An assessment of how well a company can use assets from its primary mode of business and generate revenues.

ROE

Return on Equity; a financial ratio indicating the profitability of a company in relation to its equity capital.

Q34: A goodness-of-fit test can be used to

Q49: A company makes a device that can

Q60: We expect the actual frequencies in each

Q66: If a hypothesis test for a single

Q79: After taking a speed-reading course,students are supposed

Q93: A study recently conducted by a marketing

Q96: The Cranston Hardware Company is interested in

Q101: When a pair of variables has a

Q119: When σ is unknown,the margin of error

Q139: An advertising company is interested in determining