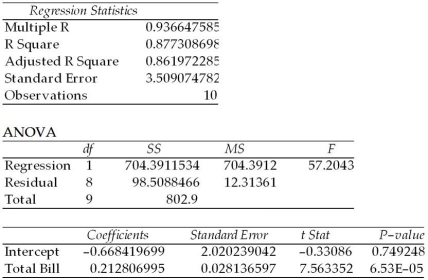

A study was recently performed by the Internal Revenue Service to determine how much tip income waiters and waitresses should make based on the size of the bill at each table.A random sample of bills and resulting tips were collected and the following regression results were observed:

SUMMARY OUTPUT  Given this output,the upper limit for the 95 percent confidence interval estimate for the true regression slope coefficient is approximately 0.28.

Given this output,the upper limit for the 95 percent confidence interval estimate for the true regression slope coefficient is approximately 0.28.

Definitions:

Qualified Expenses

Expenditures that may be eligible for tax deductions or credits, often related to education, healthcare, or investments.

Child and Dependent Care Credit

A tax credit offered to taxpayers to offset some of the costs of care for a qualifying dependent or child, to allow the taxpayer to work or look for work.

Qualified Day Care Center

A childcare facility that meets specific regulatory standards and qualifications to be recognized for certain tax benefits.

Child and Dependent Care Expense Credit

A tax credit offered to taxpayers to offset costs for the care of children or dependents, to allow them to work or look for work.

Q14: A commuter has two different routes available

Q51: One of the basic tools for creating

Q88: Which of the following is a correct

Q92: Which of the following is the difference

Q101: When a pair of variables has a

Q104: When an independent variable,that has a positive

Q121: If you suspect that a nonlinear trend

Q125: If the historical data on which the

Q134: If a pair of variables have a

Q135: In a randomized complete block design analysis