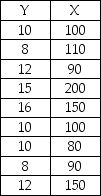

You are given the following sample data for two variables:

The sample correlation coefficient for these data is approximately r = 0.755.

The sample correlation coefficient for these data is approximately r = 0.755.

Definitions:

Risk-free Rate

The theoretical rate of return on an investment with no risk of financial loss, typically represented by government bonds.

Market Risk Premium

The additional return an investor requires for holding a risky market portfolio instead of risk-free assets, reflecting the extra risk.

Required Return

The minimum expected return by investors for investing in a particular asset, considering the risk associated with it.

Beta

It is a measure of a stock's volatility in relation to the overall market, indicating the stock's relative risk.

Q59: In a time series with quarterly sales

Q60: There have been complaints recently from homeowners

Q67: One of the assumptions associated with the

Q75: A company makes a device that can

Q83: A decision maker is considering including two

Q99: A major U.S.oil company has developed two

Q99: One of the variables that are being

Q107: When estimating the difference between two population

Q114: The Wilson Company is interested in forecasting

Q132: A company's annual sales are shown below