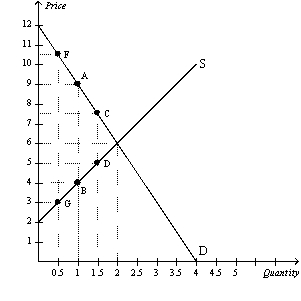

Figure 8-10

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-10.If the government changed the per-unit tax from $5.00 to $2.50,then the price paid by buyers would be $7.50,the price received by sellers would be $5,and the quantity sold in the market would be 1.5 units.Compared to the original tax rate,this lower tax rate would

Definitions:

CBC Tubes

Tubes used for collecting blood samples in complete blood count (CBC) tests, which measure various components like red and white blood cells.

Lavender

A fragrant plant with purple flowers, known for its calming and therapeutic properties, often used in aromatherapy and cosmetics.

Oversized Rubber Band

A large elastic loop made of rubber or a rubber-like material used to hold objects together or as part of physical exercise equipment.

Blood Pressure Cuff

A device used in conjunction with a sphygmomanometer to measure arterial blood pressure by constricting the arm or leg.

Q44: Refer to Table 7-9.Both the demand curve

Q61: Since air pollution creates a negative externality,<br>A)

Q153: The imposition of a tariff on imported

Q170: Refer to Figure 8-7.Which of the following

Q239: When,in our analysis of the gains and

Q253: Suppose that policymakers are considering placing a

Q260: Refer to Figure 8-10.If the government changed

Q300: Which of the following will cause a

Q305: Refer to Scenario 8-1.If John cleans Claudia's

Q336: Refer to Figure 7-17.At equilibrium,total surplus is