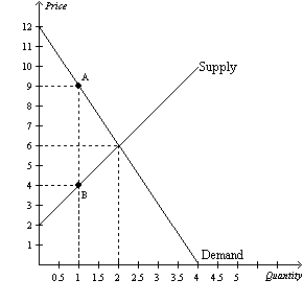

Figure 8-2

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-2.The loss of consumer surplus associated with some buyers dropping out of the market as a result of the tax is

Definitions:

Homogeneous Products

Products that are identical in quality and cannot be distinguished by consumers, making them perfect substitutes.

Marginal Revenue

The additional revenue that a firm receives from selling one more unit of a product or service.

Perfectly Competitive Industry

A market structure where many firms offer identical products, and no single buyer or seller has the market power to influence prices.

Price Setters

Firms or entities that have the ability to influence or set the price of goods and services in a market due to lack of competition or market dominance.

Q80: Refer to Figure 7-16.At equilibrium,total surplus is

Q97: A tax on a good<br>A) raises the

Q104: Who once said that taxes are the

Q178: For any country that allows free trade,<br>A)

Q200: If the demand curve and the supply

Q206: Refer to Figure 9-15.With the tariff,the quantity

Q222: When a government imposes a tariff on

Q256: On a graph,the area below a demand

Q262: Consumer surplus in a market can be

Q284: The government's benefit from a tax can