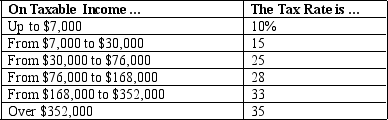

Table 12-1

-Refer to Table 12-1.If Barb has $126,000 in taxable income,her tax liability will be

Definitions:

Client Care Area

Specific designated spaces within healthcare settings where clinical or therapeutic services are provided to patients.

Healthcare Provider

A trained professional or organization that offers services related to maintaining or improving health, including doctors, nurses, clinics, and hospitals.

IV Catheter

A medical device inserted into a vein to administer fluids, medications, or nutrients directly into the bloodstream or to draw blood.

Surgical Drain

A medical device used to remove pus, blood, or other fluids from a wound or surgical site, to prevent infection and promote healing.

Q7: The marginal cost curve intersects the average

Q59: Use Table A to complete Table B.<br>

Q128: If only a few people are affected

Q166: Tax evasion is illegal,but tax avoidance is

Q183: Which of the following statements about state

Q184: Which of the following expressions is correct?<br>A)

Q185: The value and cost of goods are

Q239: The free-rider problem arises when the number

Q249: If all taxpayers pay the same percentage

Q267: Sue earns income of $80,000 per year.Her