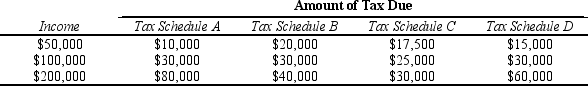

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedules are proportional?

Definitions:

Foreign Corrupt Practices Act

A U.S. law that prohibits companies from bribing foreign officials to obtain or retain business.

General Agreement

A broadly defined consensus or mutual understanding between parties on a range of issues or terms of engagement.

Building Trust

The process of establishing confidence in an entity's integrity, reliability, and competency over time within relationships.

Tariffs

Taxes imposed by a government on imported or exported goods, usually to protect domestic industries or to generate revenue.

Q24: Which of the following must always be

Q80: Suppose that for a particular firm the

Q81: Reggie,Rachael,and Rudy all enjoy looking at flowers

Q112: Refer to Figure 13-7.The efficient scale of

Q130: Which of the following is not an

Q142: Suppose that a small county is considering

Q167: The difference between specific knowledge and general

Q192: The value of a business owner's time

Q405: In the long run Firm A incurs

Q433: Refer to Table 13-3.What is total output