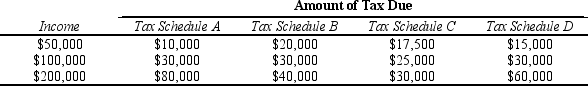

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedule could be considered a lump-sum tax?

Definitions:

Quiet Possession

The guarantee that a tenant can use the rented property without interference from the landlord or other claims against the property.

Registered

A formal process of recording information, typically in an official registry, to ensure legal recognition and protection.

Transfer of Property

The legal process by which the ownership of property is transferred from one party to another.

Fixtures

Items of personal property that have been attached to real property in such a way that they are considered legally part of the real property.

Q100: Refer to Figure 13-9.Which of the curves

Q120: The single largest expenditure by state and

Q184: Income taxes and property taxes generate the

Q201: When the value of a human life

Q225: Economists play an important role in the

Q235: Refer to Table 13-7.What is the variable

Q254: Refer to Table 13-6.What is the shape

Q303: Sue earns income of $80,000 per year.Her

Q328: For state and local governments,sales taxes and

Q424: One assumption that distinguishes short-run cost analysis