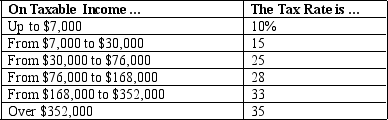

Table 12-1

-Refer to Table 12-1.If Andrea has $85,000 in taxable income,her marginal tax rate is

Definitions:

Gadgets

Small electronic or mechanical devices or tools that are innovative and designed for a particular purpose.

Significant Quantities

Items or entities in considerable amounts that are large enough to warrant attention or impact assessment.

Inventory

Inventory refers to the goods and materials that a business holds for the ultimate goal of resale or processing, including raw materials, work-in-progress, and finished goods.

Manufacturing

The process of converting raw materials or components into finished goods through the use of tools, machinery, and labor.

Q59: Who among the following is a free

Q118: If Nebraska imposed a tax on milk

Q182: Which of the following is not a

Q185: The value and cost of goods are

Q189: Refer to Scenario 12-1.Assume that the government

Q250: Horizontal equity refers to a tax system

Q323: When the marginal product of an input

Q345: Which of the following in not a

Q350: Which of the following is an advantage

Q355: Suppose the government imposes a tax of