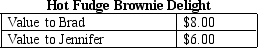

Table 12-4

-Refer to Table 12-4.Suppose that the government imposes a $2 tax on delights,causing the price to increase from $5.00 to $7.00.Deadweight loss arises because

Definitions:

Material Resources

Physical items such as equipment, buildings, and raw materials that are used in the operation of a business or project.

Trademarks

Legal protections for logos, names, and other unique marks that distinguish goods or services and protect them from being used without permission.

Raw Materials

The basic, unprocessed resources required for manufacturing goods or providing services, such as metals, wood, oil, or agricultural products.

Outsourcing

Is the process of hiring outside firms to handle basic HRM functions, presumably more efficiently than the organization could.

Q44: Which parable describes the problem of wild

Q55: What are opportunity costs? How do explicit

Q66: Corporate profits distributed as dividends are<br>A) tax

Q155: Refer to Table 11-1.Suppose the cost to

Q263: Suppose that Company A's railroad cars pass

Q288: Refer to Table 13-1.What is the marginal

Q293: Refer to Scenario 13-7.What is the shape

Q307: A budget deficit<br>A) occurs when government receipts

Q362: A tax system based on the ability-to-pay

Q401: Explicit costs<br>A) do not require an outlay