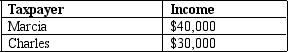

Table 12-8

-Refer to Table 12-8.If the government imposes a $3,000 lump-sum tax,the marginal tax rate for Charles would be

Definitions:

Canadian Tariff

A tax imposed by the Canadian government on imported goods to protect domestic industries or to generate revenue.

French Wine

Wine produced in the various wine regions of France, known worldwide for its quality and variety.

Price Of Wine

The amount of money required to purchase a specific amount or bottle of wine, influenced by factors like quality, brand, and production costs.

U.S. Goods

Products that are manufactured or produced within the United States.

Q21: Refer to Table 12-9.For this tax schedule,what

Q50: A person's tax liability refers to<br>A) the

Q73: Which of the following is a disadvantage

Q88: Susan used to work as a telemarketer,earning

Q91: The fact that many inputs are fixed

Q136: For a firm,the production function represents the

Q168: Which of the following is not a

Q214: In many cases,tax loopholes are designed by

Q236: Refer to Table 12-12.Charles is a single

Q395: Refer to Figure 13-3.The graph illustrates a