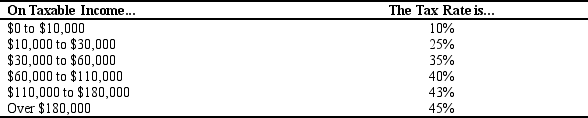

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total tax liability for an individual with $280,000 in taxable income?

Definitions:

Myosin

A type of motor protein found in muscle tissue that is involved in muscle contraction and movement by interacting with actin.

Synapses

The junctions between neurons through which electrical or chemical signals are transmitted.

Basement Membrane

A thin, dense layer of extracellular matrix that separates epithelial and endothelial cells from the underlying connective tissue.

Tendons

Strong connective tissue that connects muscles to bones, transferring the force of muscle contractions to facilitate movement.

Q19: Refer to Table 12-6.What is the average

Q60: If Mary earns $80,000 in taxable income

Q80: High marginal income tax rates<br>A) distort incentives

Q127: Refer to Scenario 13-6.In producing the 7,000

Q145: Refer to Scenario 12-3.At what level of

Q150: Refer to Table 12-1.If Barb has $126,000

Q152: With a lump-sum tax,the<br>A) marginal tax rate

Q175: Which of the following statements about costs

Q239: Fixed costs are those costs that remain

Q417: Refer to Scenario 13-8.Average fixed cost will